Introduction

We’ve all heard it before. “Content is King”. The famous phrase was first mentioned by the one and only Bill Gates in an essay published in January 1996 rightly called “Content is King”. Today, almost 25 years later, this is more true than ever. Among the most valued metrics to measure the success of content marketing is Engagement, hence why it is so crucial to understand how our audiences react to our content in order to maximize it.

No two pieces of content are alike, just like no two industries are the same. Users react differently to content generated by different categories of companies, especially if it is posted by either hedonic or utilitarian brands.

Whenever we see a study on digital content it most likely is about hedonic brands, such as fashion, food and alcoholic beverages. Hedonic brands are purchased mostly for their emotive and sensorial aspects. Affection towards hedonic brands is at the centre of why customers buy them, hence engagement is an expected result on their content marketing efforts.

On the other hand, utilitarian brands, such as banking and batteries for example, are, by definition, lacking any meaning and emotion. This is because they are mostly perceived as having very functional benefits, meaning little to no passion is involved in the purchasing decision process. As a rule of thumb, applying any past experiences and learnings from hedonic brands to utilitarian brands is not recommended given the extreme difference between their perceived emotional investment. This means that less engagement overall should be expected.

Content Engineering Studies like this are essential to utilitarian brands, such as the ones in banking and financial services, to understanding the way users consume social media content and how they react to different ways of presenting messages. This is especially true after the global financial crisis of 2007 and 2008 and the increment of online financial scams; banks are using more and more social media platforms to build trust and to strengthen their relationship with their customers.

With all the previous considerations, we found it worth researching how the banking social landscape looks like in Malaysia and to extract some initial findings about it. The following is an exploratory study for content engineering based on social media content collected from banks in Malaysia during a 1 month period.

Methodology

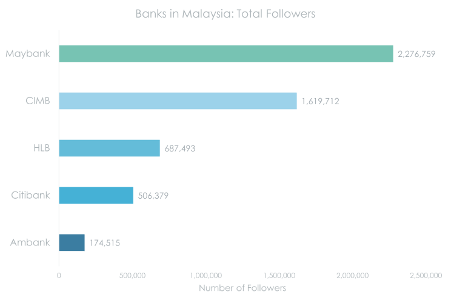

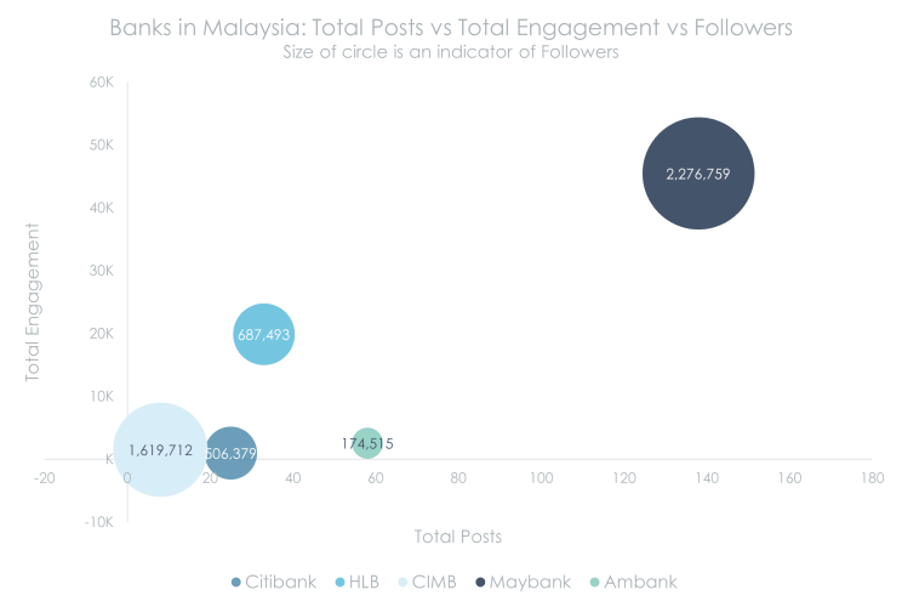

For this study we analysed the Facebook content of 5 Malaysian banks. The banks are as follows:

A Content Analysis was performed to obtain information about the content strategy of the aforementioned banks. This methodology has proven extremely useful to understand the creative strategies of brands in social media. Data was collected between a 1 month period (from 22/10/2020 to 22/11/2020), including all owned content posts with their respective engagement. A total of 264 posts were analyzed.

To better understand how persuasive messages in the content are, we included in our analysis variables of the Persuasive Communication Theory such as type of content, its format and the source of the information.

The applied research framework is taken from the Elaboration Likelihood Model (ELM) which explains how attitudes are modelled, formed and reinforced by persuasive arguments. The basic idea is that when someone is presented with any information, some level of “elaboration” must happen. Elaboration, in this context, means the effort somebody makes to evaluate, remember and accept (or reject) a message.

The model suggests that people make a certain level of effort to elaborate, be it high or low, when they receive a persuasive message. The level of elaboration determines the route of processing that message will take: a Central Route or a Peripheral Route.

A message that has taken a Central Route of processing is an indicator that the audience cares about it. They will pay more attention in order to analyse the quality and strength of the argument. A person who shows a high level of interest in a message is known as a High-Involvement Person.

On the other hand, a message that has taken a Peripheral Route of processing means it has only reached a superficial level. In this case, attention to the core message is being paid less attention than other secondary factors such as the source, appearance, presentation, etc. A person who keeps their interest in a message at a superficial level is known as a Low-Involvement Person.

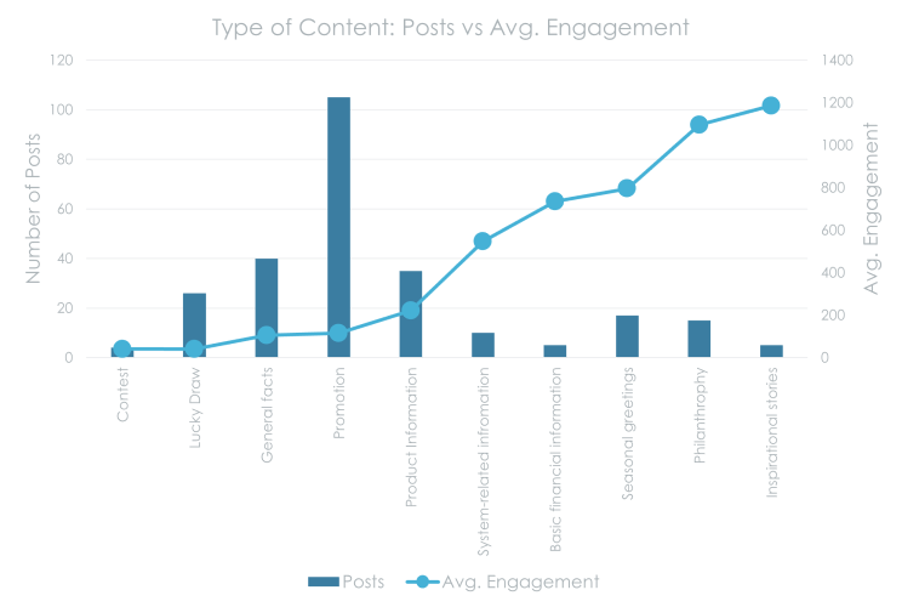

Another dimension we analysed is the Type of Content. In this case, the type of content can be divided into two categories: Informative and Persuasive.

Informative Content tries to change the beliefs about a product or its price directly. This type of content includes explicit information about the product/service/company and its offer via the Central Route to persuasion.

In contrast, Persuasive Content does not seek to promote the company or its products directly. However, it looks to create positive sentiment and build stronger relationships with its customers. This is done by using the Peripheral Route to persuasion.

The content Format was divided in 3 categories: Text, Image and Video. Each one of them has a different visual impact hence the different effect on how individuals process the messages.

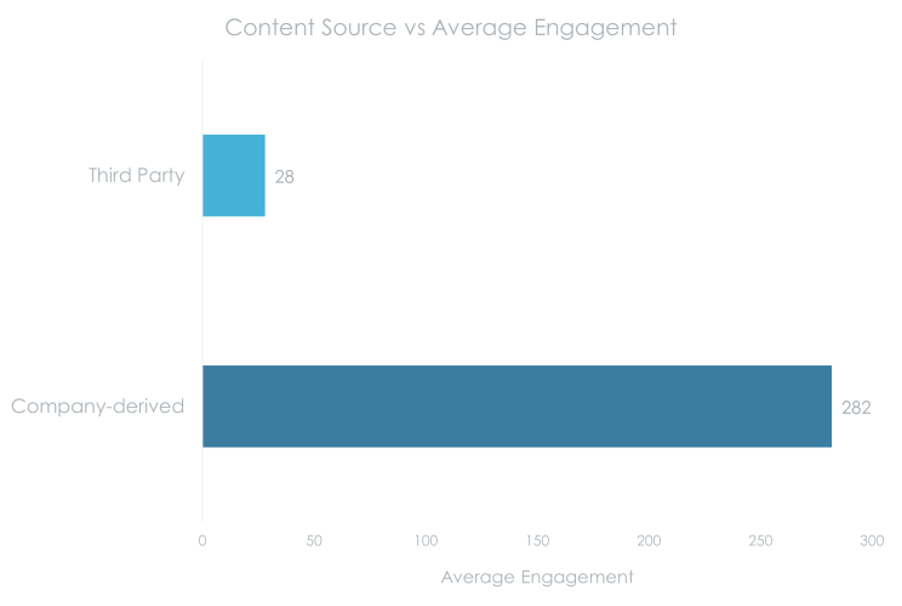

The variable Content Source was divided into 2 categories: Company-Derived Content and Third-Party Content. This is because we needed to determine if the Malaysian consumer prefers content generated by the bank or if they cared more about content generated by others.

When talking about Engagement, we divided it into two categories: Passive Engagement and Active Engagement. The former takes less analysis effort, that’s why Likes and Shares fall into this category, while the latter needs more analysis effort making Comments the right fit for this category.

Coding Guidelines

Facebook posts were categorized on 3 dimensions using the following guidelines:

Informative: If it included information about products, promotions, availability, price and product-related aspects that could be used to optimize a purchase decision. This is subdivided into whether if it's about a product, an incentive or general information and further categorized into more detailed sub categories.

Persuasive: Includes a wider range of purposes, such as humour, emotional appeal, casual banter or information on the brand’s philanthropic outreach. These messages are not specifically about the company’s offerings but are shared to modify customers’ overall beliefs, values and attitudes and to create liking, trust and relationships with the company/brand. Three subcategories can be found in this dimension: Pathos, Logos and Seasonal, with their respective subcategories.

Results

All 5 analysed banks in this study were active on Facebook during the observation period. However, results vastly differ.

Out of the 5 banks, Maybank put the most effort on its Facebook content, achieving better results in engagement vs the rest. The correlation coefficient shows that, as publications become more frequent, engagement increases.

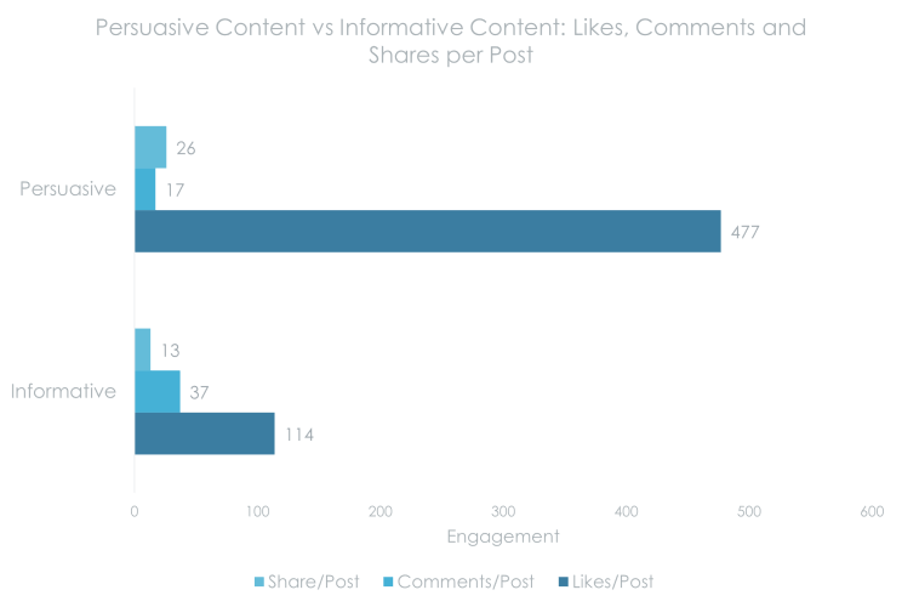

In Malaysia, Persuasive Content leads to more Passive Engagement (likes), but less Active Engagement (comments) than Informative Content.

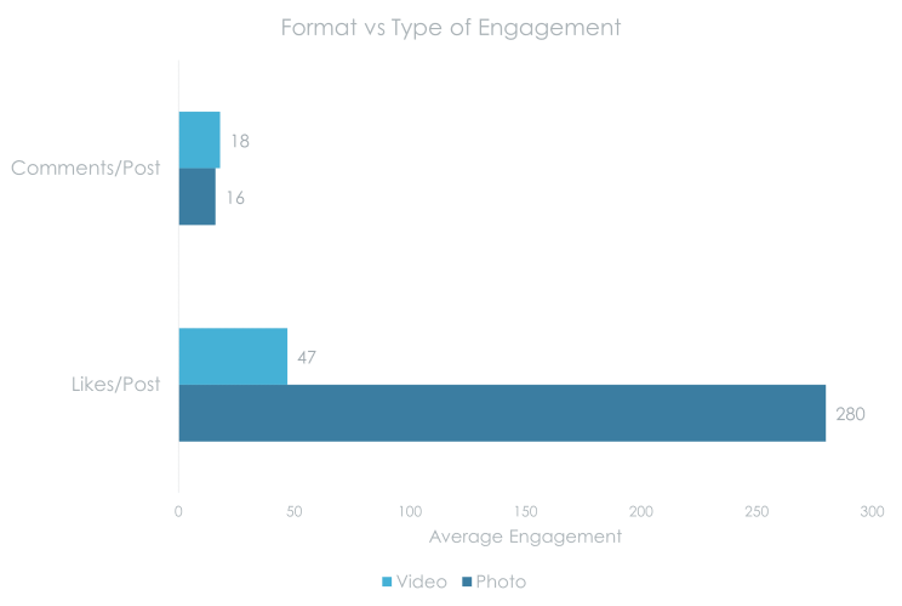

Publications with videos generated more active engagement (comments), while pictures helped to generate passive engagement.

Data indicates that Malaysian consumers show more interest in content generated by the banks rather than content written by third parties.

The 3 types of content that are more engaging are the Persuasive/Pathos. Malaysian users showed special interest in inspirational stories, philanthropic activities and in the Seasonal Greetings. This was evident when looking at the average engagement per post.

Conclusions and recommendations

Leaving aside the fact that this is an exploratory analysis using only 1 month worth of data, we can already extract some useful information regarding the way the Malaysian market reacts to messages shared by the Banking Industry in Facebook.

Although other studies usually show that the key to generate Engagement for Hedonic brands is basing their strategies on Persuasive Content, this exploratory study shows that for the Banking sector in Malaysia, the quintessential Utilitarian segment, Persuasive Content generates more Passive Engagement (likes) while Informative content generates more Active Engagement (comments).

This can be explained by the Elaboration Likelihood Model (ELM). The Banking Industry provides highly intangible and complex offers. Conversions tend to be high-risk and usually have a long-term impact. This is why the perceived value is mostly functional in nature, with a mix of emotions and a social aspect for good measure. Hence the users seeking clear and direct Central Route information about services and reacting better to logical arguments, which is a characteristic of Informative Messages. The recommendation in these cases is to use content that needs a high cognitive effort when dealing with high-involvement customers (like users deeply interested in banking products) and emotional, easy to digest content for low-involvement customers (users not yet interested in baking products).

Results show that the content that includes photos generates more passive engagement (likes), while video content generates more active engagement (comments). This suggests that videos are a great way to communicate complex banking information in an easy to understand way. On the other hand, pictures generate more indirect and superficial reactions since, apparently, those users don’t like watching the totality of the videos.

In spite of the fact that, in general, content generated by the companies themselves generates distrust when compared to content created by third parties, the Malaysian market reacts favourably to the content generated by the banks. This suggests that users like to get informed and entertained by their Persuasive Content and appreciate their efforts to produce original and creative content.

In the end of the day, it doesn't matter what kind of content and the tone and manner banks decide to use as long as they understand the implications each has on the reaction of the social media users. Studies like this are essential to shed some light into the ever changing social media landscape in order to build effective content strategies.

References

Wang, P., & McCarthy, B. (2020). What do people “like” on Facebook? Content marketing strategies used by retail bank brands in Australia and Singapore. Australasian Marketing Journal (AMJ).

Hollebeek, L.D., 2013. The customer engagement/value interface: an exploratory investigation. Aust. Market. J. 21 (1), 17–24.

Schulze, C., Schöler, L., Skiera, B., 2014. Not all fun and games: viral marketing for utilitarian products. J. Mark. 78 (1), 1–19.

Mogaji, E., Danbury, A., 2017. Making the brand appealing: advertising strategies andconsumers’ attitude towards UK retail bank brands. J. Prod. Brand Manag. 26 (6), 531–544.

Lee, D., Hosanagar, K., Nair, H.S., 2018. Advertising content and consumer engagement on social media: evidence from Facebook. Manage. Sci. 64 (11), 5105–5131.

Friestad, M., Wright, P., 1999. Everyday persuasion knowledge. Psychol. Market. 16 (2), 185–194.

Chang, Y.T., Yu, H., Lu, H.P., 2015. Persuasive messages, popularity cohesion, and message diffusion in social media marketing. J. Bus. Res. 68 (4), 777–782.